Blogs

The Future of Technology in Middle Market M&A

As technology becomes a core differentiator in M&A, middle market companies are shifting from legacy systems to scalable, digital-first models. From AI and cloud infrastructure to cybersecurity and embedded finance, tech readiness is now a key driver of deal value and buyer appetite. This white paper explores how innovation, digital resilience, and strategic positioning are redefining the future of transactions in both the U.S. and EU middle markets.

Technology is no longer a siloed consideration in M&A — it’s a foundational pillar. From how deals are sourced to how they’re integrated; digital capabilities are becoming a key part of enterprise value. In today’s middle market, the firms that command attention, premium valuations, and execution speed are those that demonstrate digital maturity.

“In a recent cross-border transaction within a digitally evolving consumer goods sector, it’s clear that investor confidence hinges not just on product or market fit, but on a company’s ability to modernize its digital backbone,” notes Johann Bosche-Salcedo, Director of the EU Office – Paris- Chiron Financial. “From ERP upgrades to integrated data systems, digital scalability has become a key value driver — especially in cross-border deals.”

This article explores the evolving role of technology in middle market M&A across the U.S. and European Union (EU). We examine current market dynamics, identify core technology trends, highlight regional differences, and offer insight into where this trajectory is heading through 2025 and beyond.

A New Landscape: Deal Value over Deal Volume

The global M&A environment has undergone a shift. While the number of deals has fallen, the average deal value has increased — particularly for targets with robust technology capabilities. Buyers are narrowing their focus, preferring fewer but more sophisticated transactions.

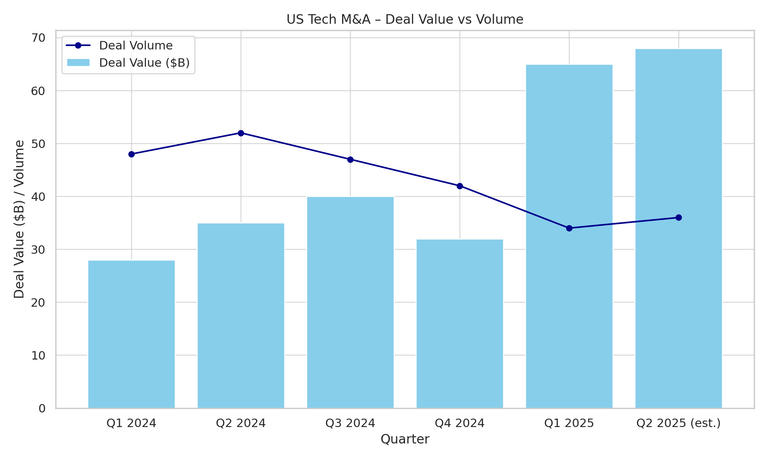

In the U.S., technology-driven M&A activity has rebounded. Recent quarters have seen a surge in deal value even as the deal count remains below pre-2022 levels.

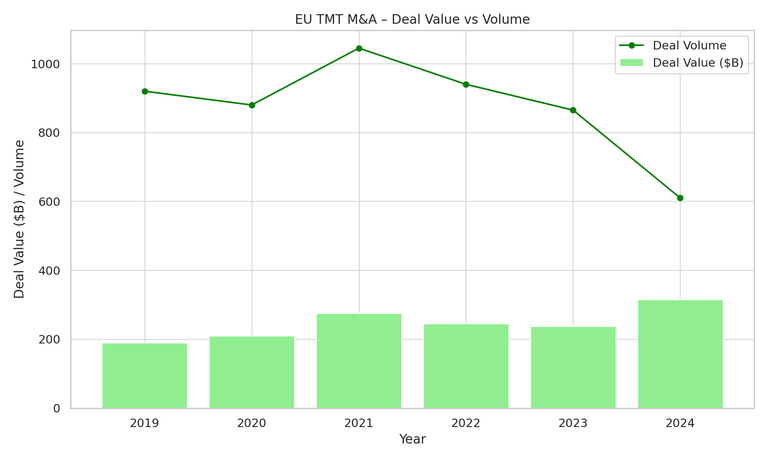

This indicates that investors are prioritizing strategic alignment and digital integration over volume. Similarly, the EU has experienced a drop in transaction numbers but a significant increase in deal value, especially in technology, media, telecom (TMT), and AI-heavy sectors. read it.

The common thread? Buyers are looking for digital scale, infrastructure readiness, and resilience — traits that technology-forward companies are more likely to exhibit.

Comparing the U.S. and EU Mid-Market Environment

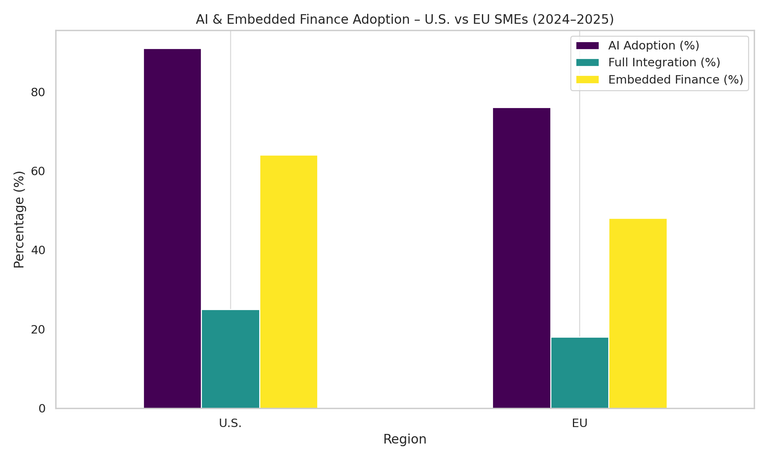

While both the U.S. and EU are leaning into technology, their deal landscapes differ in important ways. The U.S. continues to benefit from strong capital markets, broader private equity activity, and faster technology adoption. In contrast, the EU is more fragmented in capital access but shows strong intent in consolidating key infrastructure sectors and investing in regulatory-aligned digital transformation.

U.S. firms tend to move quickly, adopt AI and automation early, and integrate cloud and analytics tools as part of their operating model. EU firms, while deliberate, are investing in strategic platforms and cybersecurity modernization to meet both operational and compliance demands. As the Capital Markets Union progresses, cross-border activity is expected to grow.

Core Tech Trends Reshaping Middle Market M&A

1. AI and Predictive Analytics

- AI is no longer futuristic — it’s functional. Middle market dealmakers are using machine learning and natural language processing to source targets, assess risk, and model synergies in real time. This shortens timelines and strengthens decision-making. The impact of generative AI is also becoming more pronounced in document review, cash flow forecasting, and market monitoring.

2. Cybersecurity as a Value Lever

- Cybersecurity has transitioned from an IT concern to a valuation factor. Buyers want confidence that targets can withstand cyber threats, protect data, and recover quickly from breaches. A poor cybersecurity posture can lead to price reductions or kill a deal entirely. On the other hand, companies with strong governance and clean audit trails often gain negotiating power.

3. Cloud-First Infrastructure and Automation

- Cloud-native platforms, integrated ERPs, and real-time dashboards are now considered critical infrastructure. These tools enable scalable operations, simplify diligence, and reduce integration risk post-close. Automation of compliance, reporting, and performance tracking is viewed as a major advantage by both investors and advisors.

4. Embedded Finance and Supply Chain Digitization

- Embedded financial tools — such as B2B payments, lending APIs, or working capital platforms — are allowing companies to expand margins and improve vendor relationships. This is particularly important in sectors with supply chain complexity or international exposure. Firms that have invested in these technologies present stronger financials and greater resilience

Where We’re Headed: Predictions for 2025 and Beyond

As we look ahead, technology will become even more tightly linked to deal viability and enterprise value. Analysts forecast that AI and automation tools will be integrated into over half of all mid-market M&A transactions by the end of 2025. Companies that adopt scalable, secure, and automated infrastructure are expected to see faster exits and stronger investor interest.

More broadly, digital capabilities — especially AI and cloud-based operations — are expected to drive 20 – 30% improvements in deal cycle speed and diligence efficiency. Cyber readiness, once a differentiator, will soon become a baseline expectation.

Strategic Guidance for Operators and Investors

For founders, CFOs, and deal teams, success in this environment requires early and intentional action:

- Assess digital maturity across finance, compliance, and IT

- Identify gaps in cybersecurity and cloud-readiness

- Prepare clean, automated data flows for diligence

- Integrate technology into your value narrative

Whether you’re preparing for a capital raise, a strategic sale, or a cross-border acquisition, buyers will look for signs that your digital infrastructure supports long-term scalability and operational transparency.

How Chiron Financial Supports Tech-Forward Transactions

At Chiron Financial, we advise companies at the intersection of finance and innovation. Our services are tailored to ensure that clients can compete and win in a tech-centric M&A market.

We provide:

- Tech-readiness assessments and diligence preparation

- AI-enhanced sourcing and buyer targeting

- Strategic positioning around digital and operational value drivers

“Whether advising a legacy manufacturer or a digitally native brand, our goal is the same — helping clients unlock enterprise value through technology. Today’s buyers are looking beyond the balance sheet; they’re measuring digital agility, data infrastructure, and scalability from day one.” — Johann Bosche-Salcedo, Director, EU Office – Paris

Middle market M&A is changing — not in pace, but in priority. Buyers are not only looking for strong margins and customer growth; they want proof of digital discipline. In both the U.S. and EU, technology is now a prerequisite for scalability, integration, and risk mitigation.

Chiron Financial stands ready to help clients align with this reality and unlock full transactional value through a technology-forward strategy.

Meet Our Authors

Candice Hubert

Director, Business Development

Ms. Hubert is the Director of Business development with significant experience in the finance world.

Micaela Siekmann Guerrero

Associate, Senior Marketing and Communications

Ms. Siekmann develops and executes marketing strategies that blend content, digital campaigns, and brand storytelling to strengthen client relationships and fuel business growth.

Johann Bösch-Salcedo

Director, Europe

Mr. Bösch-Salcedo is responsible for leading the solicitation and execution of various financial advisory assignments.